Here we go again… another one of these industry-specific acronyms. FLSA, ACA, FHA… Now WOTC? What are we trying to do? Round out the alphabet?

The sales team at a payroll company are incredibly passionate about these four letters -- and for a good reason. They help several business owners realize that they can receive thousands and thousands of dollars in potential tax credits.

But as a business owner, it’s intimidating hearing these words thrown around. And it’s overwhelming - you already have enough on your plate.

We know that payroll, taxes, and confusing acronyms are probably not your passion -- but it is ours. Our goal is to help business owners understand these terms, why they’re essential, and how they can help you and your team grow - allowing you to get back to what you love.

By the end of this article, WOTC won’t be just another confusing acronym. It’ll be a push for you to learn more about how you can improve your business, save money, and hire the right person for the job.

What is it?

The Work Opportunity Tax Credit is a tax credit given to employers who hire people that face challenges finding a job.

The goal of WOTC is to incentivize diversity in the workplace and provide American workers access to great careers. When an employer hires someone who is WOTC eligible, they contribute to the economy in a meaningful way and provide opportunities to many.

Who qualifies?

The following people can qualify for WOTC:

- Ex-felons

- Veterans

- People receiving social security income or SNAP benefits

- People unemployed for a certain length of time

- People on long-term family assistance plans

(For a complete list of WOTC eligibility, check out the IRS guidelines here).

If you currently employ (or potentially could employ) someone in one of these protected categories, you need to be familiar with WOTC.

How Much are the credits?

These credits begin at $2400 per employee and can go up to $9600 per employee. The tax credit is a dollar-for-dollar reduction in an employer’s business income tax liability or their social security tax owed.

The credit is calculated by a percentage of qualified wages paid out to the employee in their first year of employment.

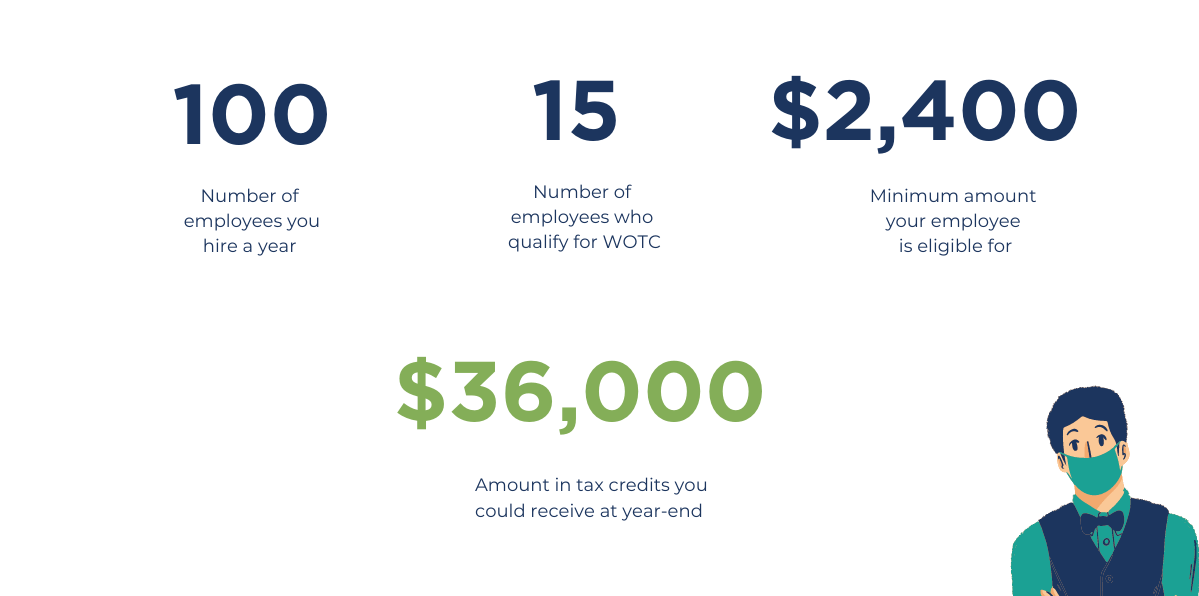

Let’s say you run a large restaurant with a staff of 100 people, and you usually hire around 100 new people a year. Most restaurants find 15-20% of their new hires will qualify for WOTC.

If 15 people qualified for WOTC and were eligible for $2400 each, the employer would have a tax credit of $36,000 to tax at year-end. Not bad, eh?

The IRS defines the maximum amount of credit per employee category. For example, the maximum credit available to an employer who hires an ex-felon is $6,000. If an employee works 400 hours within their first year of employment, the employer is entitled to a 40% of that maximum credit for a total of $2400 tax credit.

How do I get the credits?

The WOTC credit must be applied for within 28 days of your new employee’s hire.

Typically, your payroll partner will initiate this through your employee onboarding process. Your employees will be given the following to be completed with their new hire packet:

- A questionnaire

- A Form 8850

- Pre-Screening Notice and Certification Request for the Work Opportunity Credit

When they answer YES to any of those questions, your payroll company will send it to the IRS to determine eligibility. If an employee is eligible, you will be required to submit gross payroll reports quarterly to determine the amount of credit you are owed.

Taxable employers will file a Form 3800 and the business income tax return to ensure the credit is taken on their income taxes. These tax credits may also be carried forward twenty years or carried back by one year.

Are tax-exempt organizations eligible for WOTC?

Yes. Tax-exempt organizations may claim WOTC credits for qualified veterans only, and they claim their credit against their social security tax liability.

Do certain industries usually screen for WOTC eligibility?

Yes. Typically, blue-collar industries like warehousing, manufacturing, construction, and transportation will screen for WOTC eligibility.

Other industries that might qualify are:

- Non-medical home care providers

- Large retailers or factories

- Hospitality businesses like hotels and restaurants

What if I do not want to do WOTC in-house? Can I outsource this service?

YES! Most employers will outsource this service to a tax credit company or their payroll company. All WOTC paperwork is collected electronically through new hire onboarding, employers can have new employees call into a phone line. A live person will ask the WOTC questions to your new hire on an as-needed basis.

Typically, these companies will do all the post-screening work, such as filing all the necessary forms with the IRS, ensuring you meet the 28-day deadline, and pulling your gross payroll reports on an as-needed basis.

Most service providers will charge a 10-20% contingency fee based on when and if someone qualifies. This is an excellent option because it means you don’t pay for the service until you have someone that qualifies, and you are guaranteed to receive a tax credit.

If you were eligible for $36,000 in tax credits, a fee of $3600 taken out of that credit to do all the heavy lifting and work is a valuable return on investment.

What other incentives are there for WOTC employers?

Outside of the tax credits, let’s not forget the goal of this program: helping people access great jobs.

Maybe it’s an ex-felon looking for a second chance and finding an excellent job at a manufacturing plant. Or perhaps it’s a single mom receiving family assistance who loves working as a nurse’s aide at a hospice center.

The WOTC program encourages employers to think outside of the box when they consider hiring requirements. It’s a win for WOTC-eligible employers and the potential employees who may work for them.

At Whirks, we strive to help our clients get one step better every day - and sometimes that looks like understanding weird acronyms and staying up reading blog articles. If you’re eager to learn, open to change, and want to grow your business, we would be happy to see how we can help.

If you’re trying to figure out what type of HCM partner you want in your corner, check out our article on Independent vs. National providers.

Topics: