So, you're reviewing your payroll system and think it's time to look for a new payroll provider.

Before meeting with a salesperson or filling out a quote request, you want to know how much stuff costs.

That’s why we’ve created this guide—to walk you through not only our pricing but also what’s included in our payroll, HR, and benefits packages, plus the available add-ons. Read on to learn more!

The Basics

We have three basic fees to know about:

- A one-time investment

- A monthly recurring fee

- Year-end administration costs

It’s important to pay attention to the monthly recurring fee because it’s the primary driver of your cost to work with us.

How to Identify the Right Package for You

We’ve built our services like a restaurant menu at a nice steak house. You have an entrée (our service package) and then based on your preferences, you may also order a cocktail, an appetizer, or a premium side—what we call Add-Ons.

Our add-ons are à la carte, depending on what you need or may want to have. Many small businesses want to offer health insurance and will choose to add on Benefit Services or Pay-As-You-Go Workers' Compensation Insurance.

Some of you will be hiring a lot of people and want to explore an integrated applicant tracking system, like Attract & Hire that talks to the job boards and your payroll system.

Whirks Service Packages

We offer three service packages at Whirks: Core, People, and The Whirks.

CORE

Designed for businesses that need traditional payroll services.

Who is a good fit for CORE?

If you’re a growing small business and want to make sure your employees are paid on time, use technology to communicate and onboard new hires, and not worry about payroll taxes, we recommend the CORE package.

Monthly Fee

$125 monthly or $10.25 per employee per month

This service package’s monthly processing fee costs $125/month per legal entity until you have more than 13 employees. Yes, that’s PER MONTH, NOT per payroll processed.

When you have more than 13 employees, that flat rate changes to a $10.25/per employee per month rate.

One-Time Investment

15% of your annual cost

The one-time investment to get started in this package is always 15% of the annualized cost.

For a small business of $125/month, the one-time investment would be $225. Let’s say you have 25 employees and choose the core package. Your one-time fee would be $461.

Year-End Administration (Tax Filing & W2s)

At the end of the year, we reconcile your federal and state tax liabilities, as well as for each employee, submitting them to the appropriate agencies. This includes your federal and state W2 filings, as well as any 1095s for ACA compliance.

This is an annual base fee of $75 plus $7 per W2 issued.

The same pricing applies to 1095s, starting with the annual base of $75 plus $7 per form.

For a company with 25 employees who issued 25 W2s, the year-end cost would be $250.

Generally, year-end administration costs align with the one-time investment unless you’re in a very high turnover industry and you have a lot of W2s at year-end. Most payroll companies break these fees out separately, so for ease of comparison, we break these out as well.

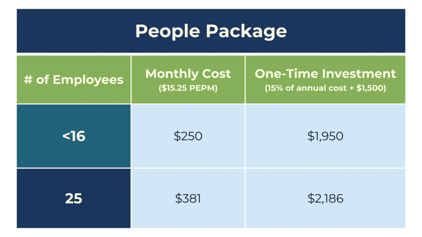

PEOPLE

Designed for businesses who need HR guidance and want to stay up to date on federal & state compliance.

Who is a good fit for PEOPLE?

If you’re a growing business and you value having an HR resource you can call anytime, we suggest the PEOPLE package. The People package includes everything in our Core package AND HR Essentials (tactical HR to help you avoid lawsuits and HR jail) for small business owners.

Monthly Fee

$250 monthly or $15.25 per employee per month

This service package’s monthly processing fee costs $250/month per legal entity until you have more than 16 employees. Yes, that’s PER MONTH, NOT per payroll processed.

When you have more than 16 employees, that flat rate changes to a $15.25/per employee per month rate.

One-Time Investment

15% of your annual cost + $1,500

The one-time investment to get started in this package is always 15% of the annualized fee + $1,500 which covers a brand-new employee handbook or reviewing your current handbook.

We curate a ‘living’ employee handbook for our clients, so we proactively add or update policies for clients as federal and state regulations change. In addition to the employee handbook, we implement HR essentials – on-call support for you to HR experts on our team, labor law posters delivered to your door, monthly Whirkshops, and an annual HR Risk assessment.

For a small business of $250/month, the one-time investment would be $1,950. Let’s say you have 25 employees and choose the PEOPLE package. The one-time fee would be $2,186.

Year-End Administration (Tax Filing & W2s)

At the end of the year, we reconcile your federal and state tax liabilities, as well as for each employee, submitting them to the appropriate agencies. This includes your federal and state W2 filings, as well as any 1095s for ACA compliance.

This is an annual base fee of $75 plus $7 per W2 issued.

The same pricing applies to 1095s, starting with the annual base of $75 plus $7 per form.

For a company with 25 employees who issued 25 W2s, the year-end cost would be $250. Generally, year-end administration costs align with the one-time investment unless you’re in a very high turnover industry and you have a lot of W2s at year-end. Most payroll companies break these fees out separately, so for ease of comparison, we break these out as well.

Just like with CORE, we suggest the complimentary add-on of Pay-As-You-Go Workers’ Compensation Insurance. If you have existing coverage, we can convert your current policy to Whirks and set it up on the pay-go model or we can quote out a new insurance policy for you to review. We are very competitive on workers’ compensation insurance rates and can often save owners money by reviewing your existing coverage.

THE WHIRKS

Designed for business owners who need to outsource payroll, streamline recruiting and onboarding, manage employee time and attendance, and access HR support—all with one trusted partner.

Who is a good fit for THE WHIRKS?

This package is designed with all the bells and whistles most businesses need for their people—recruiting new hires, onboarding new teammates, tracking hourly and salary individuals, capturing health enrollments electronically, and payroll taxes filed appropriately.

If you want to track employee time in the same system as your payroll system and need a routine way to hire new applicants, this package is perfect for you.

Monthly Fee

$350 monthly or $21.75 per employee per month

This service package’s monthly processing fee costs $300/month per legal entity until you have more than 10 employees. Yes, that’s PER MONTH, NOT per payroll processed.

When you have more than 10 employees, that flat rate changes to a $21.75/per employee per month rate.

.png?width=421&height=237&name=Whirks%20Midsize%20Business%20Price%20Guide%20(7).png)

One-Time Investment

15% of your annual cost + $1,500

The one-time investment to get started in this package is always 15% of the annualized fee + $1,500. For a small business of $300/month, the one-time investment would be $2,040. Let’s say you have 25 employees and choose The WHIRKS package. The one-time fee would be $2,478.

Year-End Administration (Tax Filing & W2s)

At the end of the year, we reconcile your federal and state tax liabilities, as well as for each employee, submitting them to the appropriate agencies. This includes your federal and state W2 filings, as well as any 1095s for ACA compliance.

This is an annual base fee of $75 plus $7 per W2 issued.

The same pricing applies to 1095s, starting with the annual base of $75 plus $7 per form.

For a company with 25 employees who issued 25 W2s, the year-end cost would be $250. Generally, year-end administration costs align with the one-time investment unless you’re in a very high turnover industry and you have a lot of W2s at year-end. Most payroll companies break these fees out separately, so for ease of comparison, we break these out as well.

Add-Ons

Now that you’ve reviewed our service packages, let's explore those à la carte items that might benefit your company.

Some of our add-ons are complimentary (they make your life easier and OURS easier, so we give these to you for free!) Some of our add-ons are a flat monthly fee and others are per-employee-per month.

For a comparison of our packages and add-ons, click here.

Attract & Hire – starting at $150/month

Best for restaurants, hospitality, and home care companies.

Attract & Hire is for businesses that want an integrated applicant-tracking solution (ATS) for hiring. Think about an ATS like a CRM for applicants. It’s what you use to host job descriptions, send ads to an unlimited about of job boards, and how you initiate both your interviewing and hiring practices with your candidates. You can automate interview reminders, skill assessments, and even extend offers and start background checks through our ATS. We generally recommend Attract & Hire for high-turnover industries like restaurants, hospitality, and home care.

ACA Compliance – $3.25/ per employee per month

Best for companies with more than 50 full-time employees.

Applicable Large Employers (ALEs) are required by law to offer health insurance to their employees. As an applicable large employer, employers are required to offer health insurance that meets minimal acceptable coverage and issue Form 1095s at year-end to confirm that you offered the appropriate coverage at the right time to the right employees throughout the year. Our ACA Compliance Add-On means we will handle the reporting requirements you have as an ALE and issue 1095s on your behalf at year-end.

For more information about the Affordable Care Act and ACA Compliance, check out this ACA Guide. Please note, ACA is a very serious mandate and the cost of not following ACA compliance can negatively impact a growing organization. If you’d like to talk about your specific questions, contact our team to learn more.

Benefit Services – starting at $15/per insured employee per month (minimum of $150/month)

Best for businesses who want to offer great insurance coverage to their employees and provide concierge support directly to their employees.

If you’re a growing business and you value your employees but do not want to lift a finger when it comes to having insurance, offering insurance, and how that relates to your employees' paychecks, this is the add-on for you. It is designed for an owner who is looking at Professional Employer Organization services or complete concierge and managed services for their employees. This is NOT a PEO, but it has all the perks of a PEO organization without the co-employment contract and the 2-3% cost of your annual payroll to service it. Curious if a PEO is right for you, learn more about the pros and cons here.

If you are offering health insurance to your employees, there are additional compliance requirements like Section 125 compliance, COBRA, and POP documents that must be maintained in order to be compliant with federal law. Offering these benefits also necessitates back-and-forth communication with your employees and carriers during open enrollment, life-qualifying events, etc.

These are burdens you shouldn’t have to manage and with our Benefit Services, you don’t! This is best for businesses who want to offer good insurance plans AND provide concierge support for their employees on plan selection and regular maintenance.

Expense Management – $1.75/ per employee per month + $100 setup fee

For businesses who want to simplify reimbursements that need to hit their employees’ paychecks.

Through Expense Management, employees are able to request and validate reimbursement for company expenses easily through their Self-Service accounts. Reimbursement requests flow through an automated approval workflow, allowing administrators to properly categorize and document the expenses. The Expense Dashboard provides real-time data of all requests in process and/or committed (added to payroll for payment).

Having clear records of expense reimbursements allows business owners to scrutinize the overall impact on their company’s budget and provides employees direct access to the history and accuracy of incurred expenses. We generally recommend this service for Home Care companies and Sales Team Operations.

Giving and Volunteering – Complimentary Add-On

Best for non-profits and businesses who regularly volunteer in their community.

Giving and Volunteering is for a business who wants to track volunteer hours, opportunities, and campaigns for their company. Through Giving and Volunteering, employers can allow employees to donate to any 501c3 in the United States through their paycheck. Employees can allocate one-time donations or recurring donations to come out of their paychecks.

For non-profit-minded employers, employers can even offer a donation match for certain employer-sponsored non-profits. Giving and Volunteering is designed for employers who want to foster corporate giving and volunteer engagement with their local community.

Learn & Grow – $5.25/ per employee per month

Best for companies who require new hire training and ongoing online training for professional development.

Learn & Grow is for a business who wants an online on-demand training platform to upload video content for new hires and continuing education for existing hires. Through Learn & Grow, you can create your own courses, upload content, videos, quizzes, and ensure that new employees and existing teammates stay up to date with your training and learning needs.

Learn & Grow is an excellent tool for a company that already has training blocks in place and needs an online way of tracking completion, encouraging and fostering completion, and values single-sign-on access for all employee-related tasks. Learn & Grow also comes with over 160 courses pre-built into the system that you can assign to employees like sexual harassment training, Microsoft, soft skills, and much more.

Pay-As-You-Go Workers’ Compensation – Complimentary Add-On

Pay-As-You-Go insurance is an effective cash flow tool for employers. When Whirks is the broker of record for your workers’ compensation policy we pay your premiums on every pay period and handle your workers’ compensation audit for you at year-end.

The best part is that you don’t have to pay 25% down on your policy and true it up at the end of the policy period. Reach out for a quote on your insurance needs today. As a complimentary add-on, when we handle your insurance, we will set up Pay-As-You-Go Workers’ Compensation at no additional cost to you. Check out our blog to learn more.

PTO Management & Accrual Tracking – Complimentary Add-On

Any employer who offers a paid time off or sick leave policy needs this add-on.

This is how we automate the accrual of your PTO policy and allow employees to request PTO within your payroll system. Managers receive notifications and can approve or deny these PTO requests. Many employers over-complicate PTO policies, and if yours is tough to keep up with, here are our suggestions for what should be included in your PTO policy.

Self-Service Benefit Administration – Custom Quote

Best for businesses who want to handle their own insurance administration but need health insurance plans.

If you offer group health insurance and want us to quote your plans, this is the add-on for you. You can select the plans of your choice with us and you can self-administer plans. This is best for companies who have an internal HR team in place that works with employees but still needs an insurance broker.

Time & Attendance – $3.25/per employee per month

If you have hourly employees and need to track their hours directly within our system, this add-on is for you.

We have a variety of tracking options like physical clocks (biometric recognition, passcodes, and PIN numbers), as well as clocking in/out from a phone or on any Wi-Fi-enabled device like your employees’ work computer or iPad. We generally recommend Time & Attendance for employers with hourly staff that do not track time in their point-of-sale systems like medical practitioners, hospice care workers, blue-collar manufacturers, or white-collar hourly employees.

Work Opportunity Tax Credit Services – Complimentary Add-On

WOTC is a MUST add when employers have a large turnover or hire a lot of tipped and hourly workers.

The Work Opportunity Tax Credit (WOTC) is a federal dollar-for-dollar tax credit to employers who hire people in IRS-protected categories such as ex-felons, ex-veterans, or employees who receive social security assistance, food stamps, or disability compensation. WOTC is based on total wages paid out to the employee every year and must be reported to the IRS within 28 days of hire or employers forfeit the possible tax credit.

Tax credits start at $2,400 per employee. Great industries eligible for WOTC are restaurants, hospitality, hotels, manufacturing, transportation, non-medical home care agencies, and some medical practices. For more information, check out our answers to eight common questions about WOTC.

Retirement Plan Submission – $50 per payroll process + $125 setup fee

Retirement Plan Submission is ideal for any company that offers a 401K plan of some kind. We can automate the submission of your payment to your 401K plan (with select plans). This allows us to report 401k changes when employees make changes to their contribution and takes one more to-do off your plate. We don’t currently work with all 401K brokers for this service, so please be able to tell your salesperson what provider you’re with so that we can confirm we can automate this for you.

Is Whirks the Right Fit for My Team?

We understand the unique challenges faced by small businesses. At Whirks, we believe in simplifying your financial and people complexities to help you and your business get one step better every day.

If you’re interested in scheduling a discovery call, don't be shy!

Not ready yet? No worries, learn more about what implementation would look like with us first!

Topics: